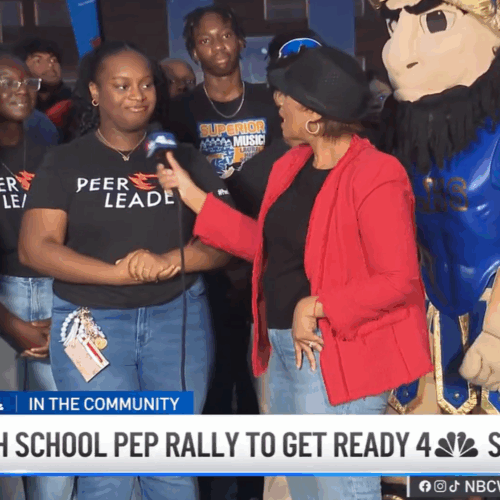

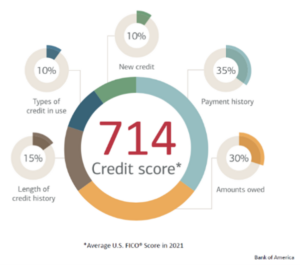

During the last semester of the school year, Erica Jones and Ximena Delgado from Bank of America joined 50+ students and Peer Leaders at Castlemont High School in Oakland, California to share practical money management guidance and insights. The focus was on understanding the components of a credit score, the dos and don’ts of building credit, how interest works, and how to build a budget. Students played a “Numbers Game” that showed the impact of different spending choices and the importance of planning for unexpected expenses. It was an informative (and fun!) session that provided pointers on how to set yourself up for financial success.

Key takeaways included:

- Smart Credit Moves

- Do: pay your bills on time, pay your bills in full/more than the minimum, and monitor your credit report.

- Do: Build credit by opening a secured credit card account (guaranteed by a security deposit) and show that you can make regular payments.

- Don’t: use all your credit, close unused accounts, or apply for too many credit cards or lines of credit.

- Budgeting For Real Life:

- Sticking to a budget can help you live within your means.

- Life happens! Saving money in case of emergencies will help you stay afloat when the unexpected happens.

- Understanding needs vs. wants will help you manage your money better.

Berenice Vega, College and Career Readiness Specialist at Castlemont, noted, “This workshop with Bank of America was great, especially getting to see the shift in students when it comes to credit, budgeting and real-life expenses they don’t think about right now. It’s never too early to have these conversations, as many of our students participate in paid internships and begin to think in strategic ways about how to save or use their money. This is a great way to get students thinking about money in the future and how to budget with their life choices, whether it’s working, going to a 2- or 4-year college, or doing an apprenticeship program.”

In closing out, Erica encouraged the group with these words of wisdom: “Remember, your credit score is not a judgement about you as a person – it’s about your financial reputation. Use these tools and strategies to build it up and then put it to work for you, to open doors and unlock possibilities!”

Big thanks to Bank of America for leading the way with sharing these critical financial literacy skills! More financial resources, including material created specifically for students, can be found on their Better Money Habits resource center.